- Solutions

- AI First Services

- Business Outcomes

- Industry AI Accelerators

- Insights & Resources

- About

For business management solutions email us or call 020 3004 4600

You may have noticed a few issues that have recently come to your attention as a result of the new setup in Business Central. In our latest tips & tricks article, we will take you through how to address these posting date issues.

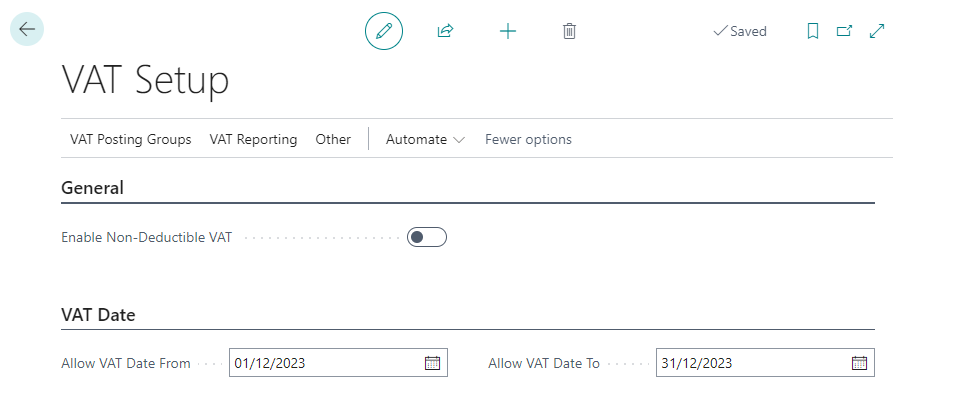

VAT Setup

If you login to Business Central, you will find that Microsoft has added a new page called ‘VAT Setup’. You will also notice that this includes the new ‘VAT Date controls’, the ‘Allow VAT Date From’ and ‘Allow VAT Date To’. This means that they will stop any postings that look to use a ‘VAT Date’ outside this range, unless the user has been given an exception on the ‘User Setup’ page.

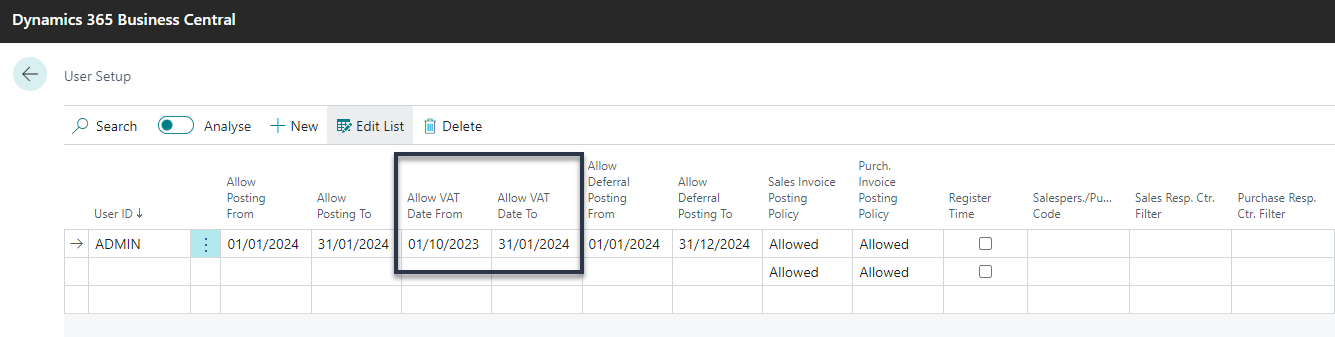

User Setup

You will find that the ‘User Setup’ page includes added columns to enable you to grant an exception where needed to certain users to enable them to use a VAT date outside the above setting. From the screenshot below, you will see that the user is posting in Jan 2024, however their VAT Dates allow them to also post with a VAT Date that falls into Q4 of 2023.

NB: It is important to note that this is not VAT advice, this is a review of the apparent behaviour of a new function in the system, if you feel that you require extra VAT advice, please reach out to an appropriate person. Also, the examples above are just discussion points and not a recommended way of setting it up.

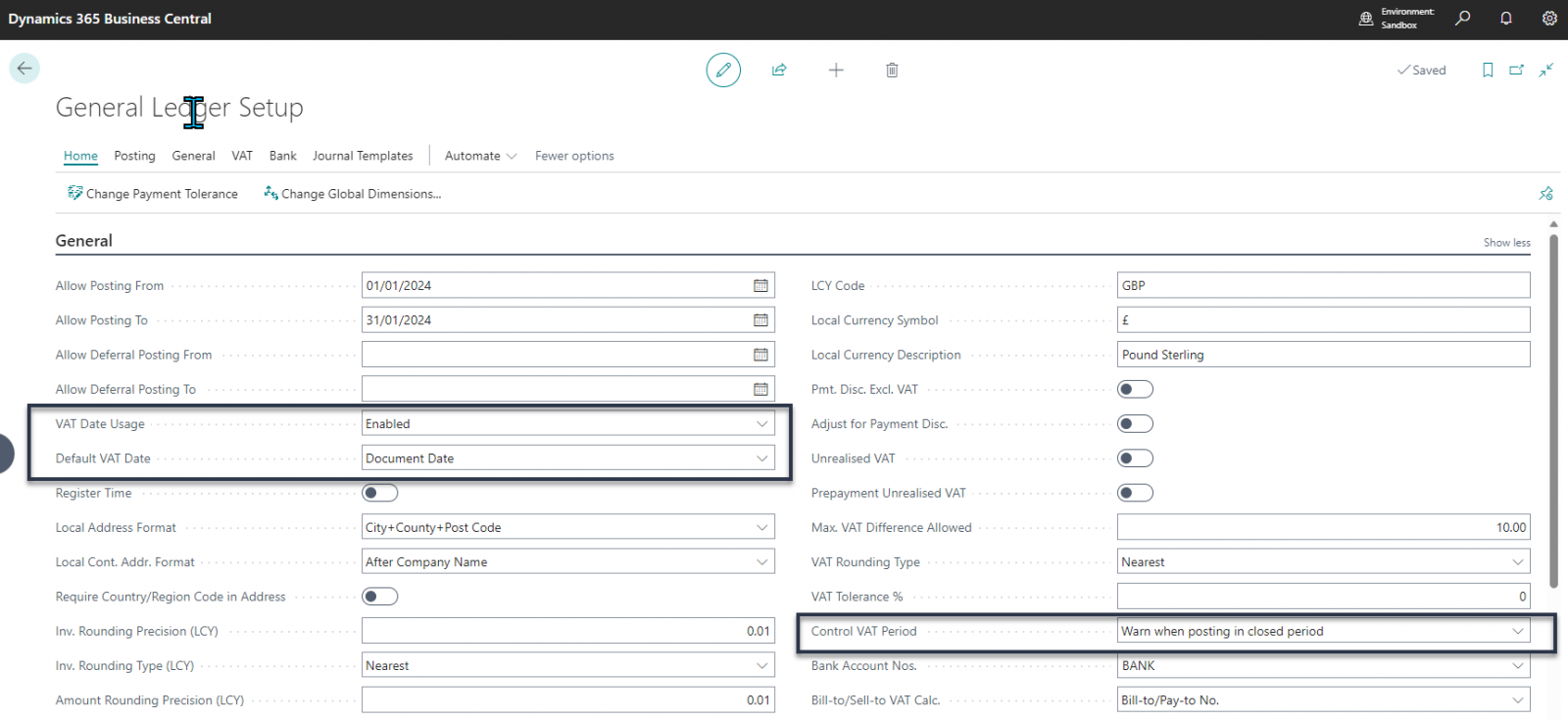

General Ledger Setup

You will notice that the above setup is only useful if you are making use of the ‘Default VAT Date’ field with the option of ‘Document Date’, this enables you to post late received purchase invoices and use the actual tax point from the invoice as the Document Date and use this to set the VAT Date field, you will notice that this now has a control to keep things to the current VAT period.

In theory, the above already existed under the ‘Control VAT period’ field that has options to block posting in closed VAT periods or warn when posting into a closed VAT period.

Ok, I get the above but what is the problem?

This new feature was put into preview in November then went live in December. Therefore, when it was enabled by Microsoft it used whatever dates were in the General Ledger Setup, even if the VAT date functionality was switched off. What this means is that any users who are coming back from their Christmas break to start working, posting errors may happen as the company will be using January as its posting date allowed period however the VAT setup page that they won’t know about will still have the December dates that it used, thus stopping posts from being made. This has already happened to some of our customers, who had different setups but still had the same result, they couldn't post invoices.

Ok, so how can this be resolved?

The good news is that the fix is relatively simple, you will need to simply update this new page as part of your month end / period end process, keep the dates in the ‘VAT Setup page’ either in line with your posting date control or in line with your next VAT return depending on how you currently process these. You will find that it should be a one-off error as it was caused by this new page taking the dates set on the General Ledger setup. Therefore, if you have the ‘VAT Date Usage’ field set to ‘Disabled’, you will not be able to see the VAT Date fields on the VAT Setup page, so you will have to quickly enable this feature, clear the fields and disable it again. To make sure that you keep your data protected, we would suggest that you pause all activity when you do this, just to stop new documents being created that use a different VAT date.

Next Steps?

If you are a business that is using Business Central as your ERP system and are experiencing the above problem and are looking for some extra Business Central support to help resolve this then please reach out to our team of Business Central experts now to get the help you need.

Want to get tips & tricks articles like the above sent to your inbox? You can if you sign up to our mailing list.