- Solutions

- Services

- Business Outcomes

- Industry AI Accelerators

- Insights & Resources

- About

For business management solutions email us or call 020 3004 4600

If you are a regular user of Dynamics GP, you will want to pick up as much as knowledge as possible to make your day to day job much easier.

One such question that often arises within many businesses is ‘How should I process the different kinds of payments found in my Bank Statement so that I can complete my Bank Reconciliation?’. Within Dynamics GP, there are a number of ways to process payments to the system which will then form reconcilable payment lines in the Bank Reconciliation screen.

Before you start, you need to ask yourself the following:

In our latest tips and tricks article, we provide you with 5 ways to process payments which will then be reconcilable to your bank statement in Dynamics GP.

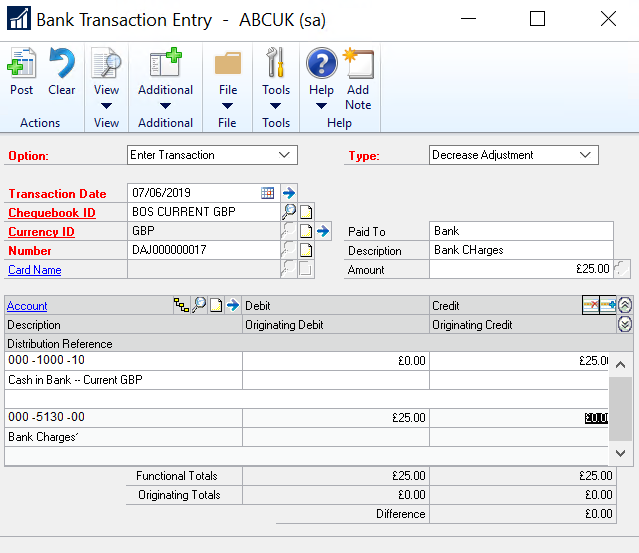

Method 1: If the payment does not relate to a Purchase Ledger invoice or a Sales Ledger refund, then you will normally use one of the 3 payment options in the Bank Transaction Entry screen: Go to ‘Financial’ followed by ‘Transactions’ then click on ‘Bank Transactions’.

The Payment Options include a Cheque, Withdrawal and a Decrease Adjustment. Cheque could be used if you physically write a cheque for a payee which is not setup as a supplier. A withdrawal represents an electronic withdrawal of cash from your bank e.g. a non-Purchase Ledger Direct Debit or Chaps Payment. A Decrease Adjustment would typically be used for bank charges or bank interest paid.

Once you have entered a transaction date, cheque book, payment number and payee details/amount, you will find that the cash book journal starts to be created automatically, by defaulting in the associated cash account GL code and the correct credit amount. You then manually enter the GL code(s) to be debited and then Post.

Method 2: Purchase ledger payments are mainly produced using EFT (known as BACS in the UK) Payment Batch Processing within GP, so these transactions will already have been instigated from within GP before reaching your Bank Statement. Unfortunately, the individual EFT payments show in the GP Bank Reconciliation screen rather that the total value of the EFT batch, which is often the amount shown on the Bank Statement.

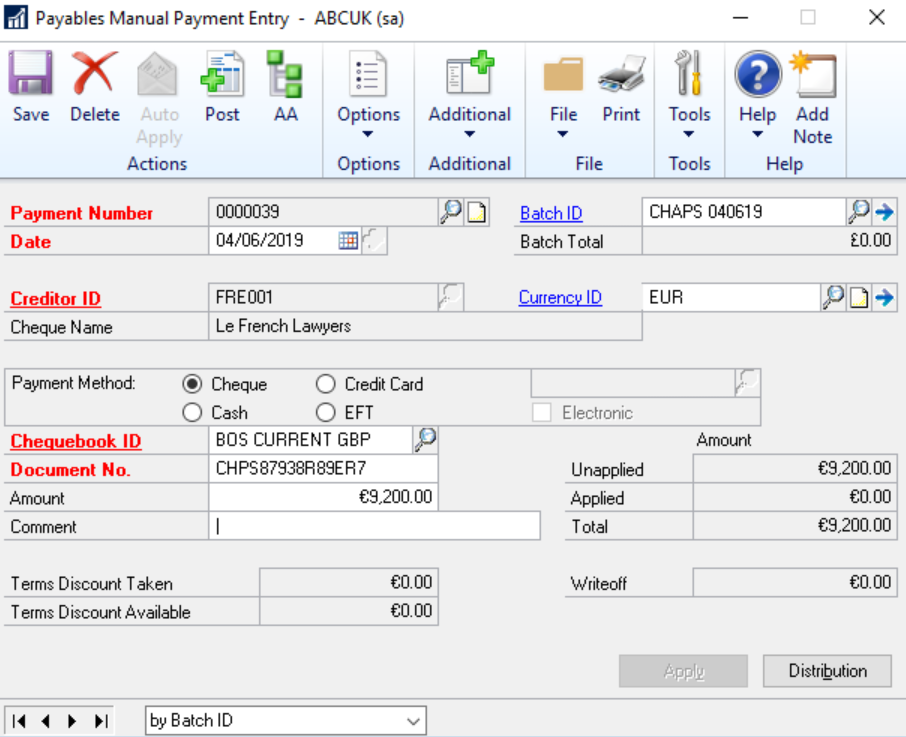

Other Purchase Ledger payments will tend to be either Chaps, Direct Debit, Credit Card and occasionally cash. You will need to use the Manual Payments screen to achieve this, unless you are importing such transactions using either the Integration Manager or SmartConnect integration tools (Please speak to Advantage Business Systems if this form or data input would be useful to your business). Simply go to ‘Purchasing’ followed by ‘Transactions’ then ‘Manual Payments’.

Ensure you have the correct Date, Creditor, Currency, Chequebook and Amount.

Note: The Expansion button next to the Currency field allows you to enter a spot rate for each transaction, as determined by the Bank and specified on the Bank Statement. By entering the specific rate, the correct FX gain or loss will be calculated automatically by Dynamics GP as the payment is applied to the Invoice. This has to be done after the payment is posted for foreign payments.

The Payment Methods are a little limiting in choice and people tend to select ‘Cheque’ for DDs and Chaps payments. If you select Credit Card, the Credit Card’s creditor record must be selected and a purchase ledger invoice will be automatically created for this credit card company.

It is useful to make sure that the Document No’ field reflects the unique Bank Statement payment line reference as this makes reconciliation within the Bank Rec screen easier.

Once you have entered the payment, unless it is foreign, you will be able to match it to the invoice(s) to which it relates, via the Apply button at the bottom. You can part apply, spread the payment across multiple invoices and write off invoice amounts within this screen.

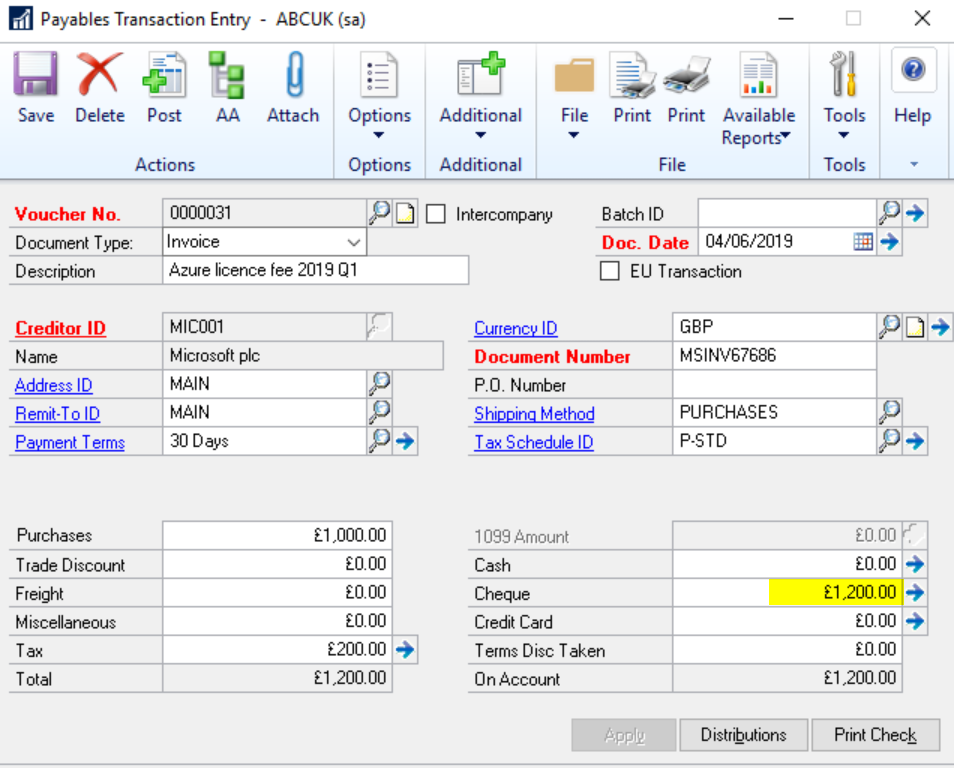

Method 3: If the payment relates to a purchase ledger invoice which has not yet been processed, you can enter the payment on the invoice as you process it. Go to ‘Purchasing’ followed by ‘Transactions’ then ‘Transaction Entry’.

Enter the Invoice as normal and then enter the payment details at the bottom on the right hand side. The payment will automatically apply to the invoice and send the payment information to the Bank Rec screen.

Method 4: If the payment is for an immaterial financial value or does not need traceability within the purchase ledger, you can then enter it quickly within the Bank Reconciliation Screen.

Go to ‘Financial’ followed by ‘Transactions’ then ‘Reconcile Bank Statement’. Choose the Chequebook, enter the Bank Statement Ending Balance and Date and then click on the Transactions button at the bottom. This will open the ‘Select Bank Transactions’ screen which displays all currently unreconciled payments and receipts. At the bottom of the screen there is an ‘Adjustments’ button. Here you can select 4 transaction types including 2 payments: Other Expense and Service Fees. Choose one of these, enter the GL code to which it refers and the payment amount as a positive value. The Bank Journal entry will adjust the reconciliation figures and post at the point at which you ‘Reconcile’ the Bank Statement. This screen is typically used for bank charges and interest payable and small clearing differences.

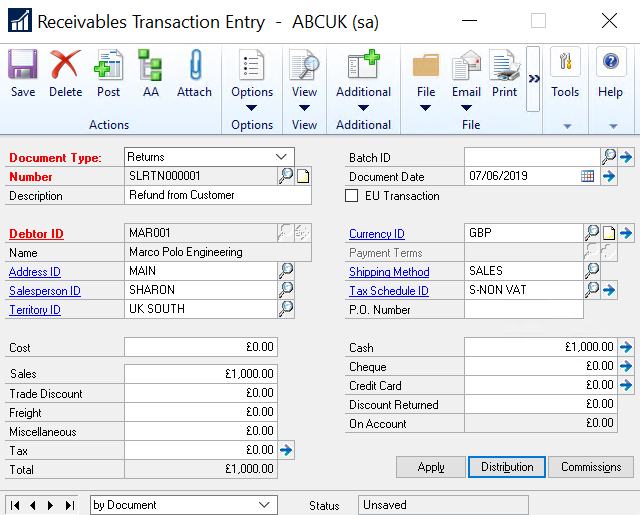

Method 5: If the payment relates to a Sales Ledger Refund, it can be entered as a Receivables Management ‘Return’ transaction. Go to ‘Sales’ followed by ‘Transactions’ then ‘Transaction Entry’. Having selected the Return transaction type, enter the amount as a Non-Vatable transaction but also enter the value of the payment in the bottom right hand box as Cash, Cheque or Credit Card.

Note: Depending on the circumstances surrounding the refund, you may also have to enter a debit sales transaction to contra the value of any outstanding credits on account with this customer.

If you are struggling to do any of the above tasks, are looking to upgrade your current GP solution, need more GP support or tailored GP training then please get in touch with our team of GP experts today for more information.

If you want to receive more tips & tricks similar to the above, then please sign up to our mailing list.